Table of Contents

The slowdown in the otherwise pink-hot housing boom has been stunningly swift.

The U.S. housing sector surged for the duration of the pandemic as homebound people sought new spots to reside, boosted by record-small interest rates.

Now, genuine estate agents who after noted traces of prospective buyers outside the house open up properties and bidding wars on the again deck say houses are sitting down more time and sellers are becoming forced to reduce their sights.

That has the two possible prospective buyers and sellers wondering where they stand.

“As recession concerns weigh on shopper outlooks, our survey displays uncertainty has produced its way into the minds of many customers,” explained Danielle Hale, main economist at Realtor.com.

Below are the major things driving the topsy-turvy housing sector.

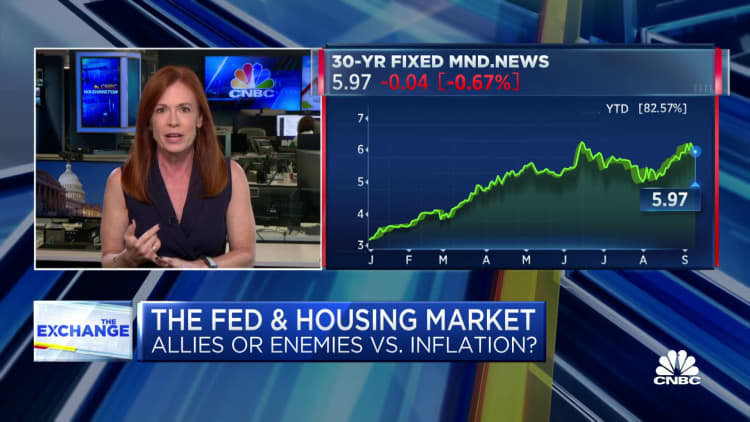

Home finance loan rates

The key driver of the slowdown is mounting property finance loan premiums. The ordinary fee on the 30-12 months fixed house loan, which is by much the most well-liked solution now, accounting for extra than 90% of all home finance loan applications, begun this 12 months appropriate about 3%. It is now just higher than 6%, according to Mortgage loan News Day by day.

That suggests a individual obtaining a $400,000 household would have a month to month payment about $700 better now than it would have been in January.

High price ranges, lower source

The other drivers of the slowdown are superior price ranges and minimal provide.

Rates are now 43% larger than they had been at the commence of the coronavirus pandemic, according to the S&P Situation-Shiller nationwide residence value index. The source of houses for sale is escalating, up 27% at the commence of September as opposed with the similar time a yr in the past, in accordance to Realtor.com. Even though that comparison looks big, it truly is continue to not sufficient to offset the yrs-long scarcity of homes for sale.

Energetic inventory is still 43% reduced than it was in 2019. New listings were being also down 6% at the conclude of September, meaning opportunity sellers are now anxious as they see additional residences sit on the sector extended.

Paul Legere is a buyer’s agent with Joel Nelson Team in Washington, D.C. He focuses on the competitive Capitol Hill neighborhood, and he explained he noticed listings soar by 20 to 171 just soon after Labor Working day. He now calls the sector “bloated.” As a comparison, just 65 households have been listed for sale in March.

“This is a pretty classic article Labor Working day inventory bump and viewing in a 7 days or so how the market absorbs the new stock is likely to be incredibly telling,” he reported. “Very.”

Inventory is getting a hit nationally simply because homebuilders are slowing manufacturing due to less likely customers touring their types. Housing commences for single-family members residences dropped 18.5% in July in contrast with July 2021, according to the U.S. Census.

“Tighter monetary plan from the Federal Reserve and persistently elevated building fees have brought on a housing economic downturn,” claimed NAHB Main Economist Robert Dietz in the August report.

Some prospective buyers are hanging in

Purchasers, nevertheless, have not disappeared solely, regardless of the however-pricey for-sale sector and the similarly pricey rental market place.

“Data implies that some dwelling purchasers are finding silver linings in the type of cooling competitiveness for increasing numbers of for-sale residence choice,” claimed Realtor.com’s Hale. “Especially for customers who are obtaining creative, these kinds of as by checking out more compact markets, this drop could convey relatively superior likelihood to come across a property within just budget.”

Even though the drop may seem to be modest, it is the major single-thirty day period decline in costs due to the fact January 2011. It is also the second-worst July functionality courting back again to 1991, driving the .9% decrease in July 2010, through the Excellent Recession.

Affordability woes

Even now, that drop in selling prices will do incredibly very little to boost the affordability disaster brought on by rising house loan charges. Whilst costs fell back again a little bit in August, they have risen sharply once again this 7 days, producing for the least affordable 7 days in housing in 35 a long time.

It now usually takes 35.51% of median money to make the every month principal and desire payment on the median dwelling with a 30-12 months house loan and 20% down. That is up marginally from the prior 35-calendar year significant again in June, when the payment-to-profits ratio attained 35.49%, in accordance to Andy Walden, vice president of business research and technique at Black Knight.

In the 5 yrs right before curiosity premiums started to increase, that cash flow-to-payment ratio held continuous all around 20%. Even however house charges surged in the 2020 and 2021, document-lower fascination premiums offset the boosts.

“Presented the substantial role affordability problems look to be participating in in shifting housing industry dynamics, the current pullback in house charges is probable to proceed,” Walden reported.

A new report from true estate brokerage Redfin showed that although homebuyer demand from customers woke up a bit in August, the most current enhance in mortgage costs in excess of the earlier week place it right again to rest. Less individuals searched for “homes for sale” on Google with searches through the week ending Sept. 3 – down 25% from a year earlier, according to the report.

Redfin’s desire index, which actions requests for property excursions and other dwelling-shopping for providers from Redfin agents, confirmed that for the duration of the seven days ending Sept. 4, demand from customers was up 18% from the 2022 very low in June, but nonetheless down 11% year more than calendar year.

“The housing sector usually cools down this time of yr,” explained Daryl Fairweather, Redfin’s chief economist, “but this calendar year I anticipate fall and wintertime to be in particular frigid as revenue dry up far more than typical.”

More Stories

The Woodlands lifetime sciences hub by Alexandria Real Estate opens

Banks report ongoing ache on industrial real estate financial loans

These Will Be the Best States To Buy Property in the Next Decade