There was a viral tweet going all over from YouTube housing influencer Nick Gerli. You’ve almost certainly witnessed it. Gerli cites data from a firm known as AllTheRooms to make the circumstance that the Airbnb/limited-phrase rental sector is “crashing” and it will have a large effects on inventory.

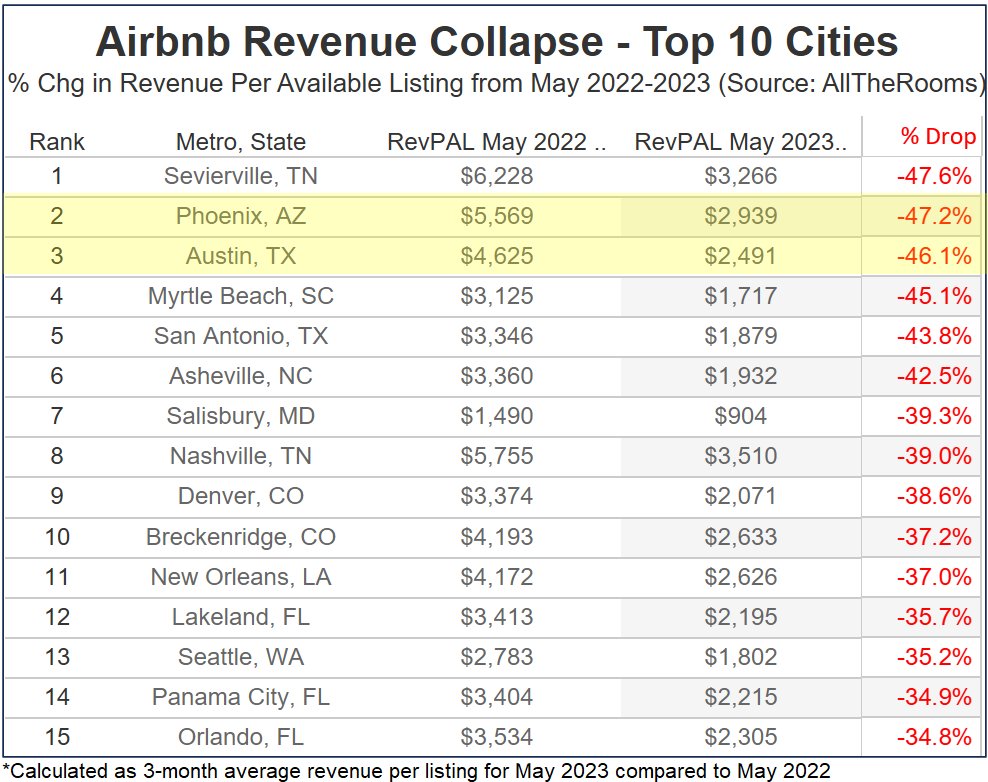

In truth, the chart he shared is alarming.

A almost 50% fall in earnings in some marketplaces!

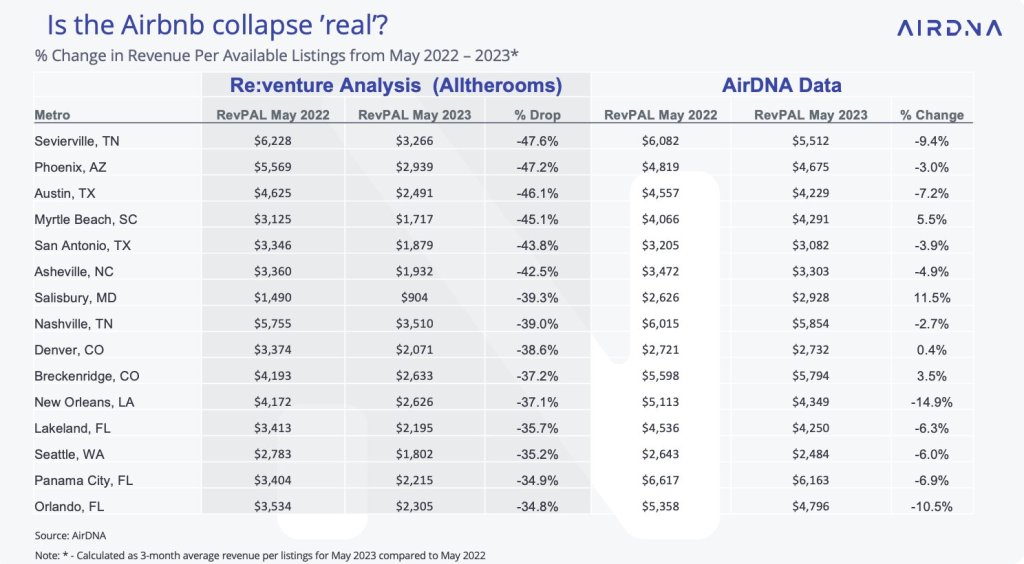

But the details looks dubious. I interviewed Jamie Lane, the chief economist and head of analytics at AirDNA. He seemed at the AllTheRooms info and ran a mirror investigation with AirDNA’s info and, nicely, just seem.

Earnings per listing is down, but it is not down by a third or a lot more in people markets, according to AirDNA.

AllTheRooms did not reply to my requests for comment, but Gerli, who operates Reventure Consulting, explained he was informed of the discrepancies in the data and had achieved out to Airbnb “to deliver their have info for these cities so we can get the most correct figures.” (Airbnb by itself explained in a assertion that the data was “not dependable with its own” and additional that “more friends are touring on Airbnb than at any time right before.”)

Gerli, having said that, did offer you higher level thoughts on the condition. His outlook continues to be bearish.

“Both facts sources agree that the Airbnb offer in The usa has surged more than the previous 2-3 years because the pandemic started off, especially in towns like Phoenix. In some marketplaces there are now 2-3x additional houses mentioned on Airbnb than for sale, a circumstance that has robbed the housing market place for inventory,” Gerli wrote in an electronic mail. “However, now that the Airbnb correction has started off, we will likely see battling Airbnb entrepreneurs seem to offer their properties. Glance for the downturn to be worse in metropolitan areas exactly where 1) the revenues declined the most and 2) there’s the optimum surplus of Airbnb stock relative to houses for sale.”

Lane at AirDNA does not see a ‘crash’ taking place, even while revenue is trending down from final yr and it is a rather saturated market in some metros (the range of listings was up 18% about the same period previous calendar year).

“I see that as an fully phony narrative,” he stated. “The small-time period rental marketplace has very healthier efficiency appropriate now. If you look at in general occupancies for 2023, the sector is going to operate 57%. That compares to a pre-COVID [level] of 55%. So we’re well previously mentioned pre COVID occupancy ranges. We are down from the 2021 highs, but that was a COVID anomaly in terms of industry functionality.”

AirDNA expects modest Airbnb revenue declines all over the rest of the year – a 1% drop for the rest of the calendar year and no advancement in 2024.

Let us dive in a minor further more. Lane maintains that the fundamentals in STR keep on being sturdy – we see decreased churn nowadays than we saw pre-pandemic, the vacation want is certainly actual, a huge section of the population is much more cellular than at any time (many thanks, remote perform!), and about 20% of listings are personal or shared rooms, not complete homes.

Far more importantly, revenue for most hosts across the state is still potent nationally, lessening the probability of forced sellers, Lane mentioned.

“If you glimpse at revenue today, ordinary income for each listing as opposed to pre-pandemic, we are 30% better, and that has hardly appear down off the highs in 2022. The earnings of shorter term rental operators have not collapsed by any signifies.”

But let’s say demand nosedives because of to a economic downturn and the quantities no for a longer time pencil out for some operators. What influence would that have on the market?

It’s hard to say, but an STR crash like the 1 Gerli describes by now did come about, back again in 2020.

“In 2020, listings fell by 25%, we noticed a lot of markets essentially decrease by fifty percent, with no disruption to the broader housing market,” Lane mentioned.

Stock, as ever, is important to all this. Presently, there are about 1.4 million shorter-expression rental listings in the U.S. although there are about 600,000 active for-sale listings. Even if all the 1.4 million STR listings hit the industry at the same time, I never think that would final result in a crash.

“Active listings in a regular time period would be involving 2 to 2.5 million,” explained HousingWire’s Lead Analyst Logan Mohtashami. “Even if all people houses came to market place right away, they would need to not get a bid above 60 days to let the active inventory to return to historical norms.”

Not that these an Airbnb inventory shock would even manifest.

Stated Lane: “When you seem at significant cities, let’s say the 50 major metros, most of that [Airbnb] inventory is not out there full time. Around 50% was readily available for lease much less than 180 times above the earlier calendar year. So it’s not full time short phrase rental investments.”

Lane argued that a flood of Airbnb’s would not even crash closely saturated marketplaces either.

“So you search at a market like Phoenix and how a lot of new households are becoming crafted any given 12 months, that’s much larger than the complete quick term rental market,” Lane explained.

The broader housing sector desires more stock any which way it can get it, but I never see considerably coming from non-practical Airbnbs. What do you feel? Share your feelings with me at [email protected].

In our weekly DataDigest e-newsletter, HW Media Running Editor James Kleimann breaks down the biggest stories in housing by way of a knowledge lens. Indication up right here! Have a matter in mind? Electronic mail him at [email protected]

More Stories

The Popularity of Hidden Halo Engagement Rings in London

The Woodlands lifetime sciences hub by Alexandria Real Estate opens

Banks report ongoing ache on industrial real estate financial loans